september child tax credit payment less than expected

Simple or complex always free. SOME eligible parents are furious they are still waiting to receive their September child tax credit payments but the IRS is promising the check is on its way.

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Per the IRS the typical overpayment was 3125 per child between the ages of.

. These individuals may not yet be able to. Some 35 million child tax credits worth 15 billion were distributed last week but roughly 2 of eligible recipients failed to receive their payment. The third payment went out on September 17 but the agency said on Friday they had to fix a.

Shouldnt we have received 1300. The maximum 2021 credit is 3600 for a child 5 and under and 3000 for older children. We received a 1000 child tax credit payment.

15 adds up to about 15 billion. 17 that it was aware. The ARP increased the 2021 child tax credit from a maximum of 2000 per child up to 3600.

We have five children 17 11 9 7 and 5. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August Child Tax Credit money. If your September child tax credit payment is still a no-show or is for a different amount than expected the IRS has finally offered a couple explanations.

Families can receive 50 of their child tax credit via monthly payments between July 15 and Dec. In addition to age your estimated total is based on your familys adjusted gross income. According to a Sept.

The expanded child tax credit pays up to 300 per child ages 5 and younger and up to 300 for children ages 6-17. Payments began in July and will continue through December with the remaining. The IRS announced earlier that the September batch of payments scheduled for Sept.

Families who did not get a July or August payment and are getting their first monthly payment in September will still receive their total advance payment for the year of up to 1800 for each child under age 6 and up to 1500 for each child ages 6 through 17. The IRS sent out the third child tax credit payments on Wednesday Sept. But the payments havent been without their glitches.

If the calculator above gives you a figure much less than 3600 total for your 3-year-old that probably means your household income is. For dependents aged 18 through 24 or full-time college students the IRS will make a one-time 500 payment in 2022. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

File a federal return to claim your child tax credit. 24 statement from. The third payment went out on September 17 We apologize The IRS said.

Some eligible parents who are missing their September child tax credit payments should get them soon. We make under 150000 a year. The good news is that in most cases the overpayments arent going to make a huge dent in the Child Tax Credit checks.

Ad Discover trends and view interactive analysis of child care and early education in the US. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. September 17 2021.

If your September child tax credit payment is still a no-show or is for a different amount than expected the IRS has finally offered a couple explanations. If your tax return was recently processed and your income increased substantially from 2019 to 2020 that could be why you received less than the full amount for your September payment. Whether or not another IRS glitch is at fault for the current.

Eligible families who do not opt-out will receive 300 monthly for each. Youll get the maximum amount if your AGI is 75000 or less as a single filer 150000 filing jointly or 112500 as a head of household. The agency said that less.

The Internal Revenue Service said Sept. We are aware of instances where some individuals have not yet received their September payments although they received payments in July and August. September 26 2021 103 PM.

The IRS may not have an. Unless you opt out of the monthlies only the other half of that will be claimed at tax time next year For every 1000 of income above the income thresholds above the credit is reduced by 50 a year until it reaches 2000 per child which works out to 166 a month. What is the child tax credit.

We know people depend on receiving these payments on time and we apologize for the delay. This means that each advance payment will be worth either 250 or 300 per child for parents jointly making less than 150000 per year or. Some child tax credit payments delayed or less than expected IRS says - NewsBreak.

The Internal Revenue Service said a technical issue is to blame for some people not receiving the September installment of the child tax credit. Many parents have been spending the money as soon as they get it on things like rent and uniforms and already the payments have helped fewer children go hungry. Get the up-to-date data and facts from USAFacts a nonpartisan source.

Even though child tax credit payments are scheduled to arrive on certain dates you may not get the money as expected for a few reasons. Some parents may not want to get the monthly payments particularly if their incomes increase this yearThe payments are credits toward families tax liability for 2021 but are based on 2020 or. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion.

Up until late Friday the IRS had been notably silent about the complaints.

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Stimulus Check For Less Than Expected The I R S Says Some Delays Are Tied To Spousal Debts The New York Times

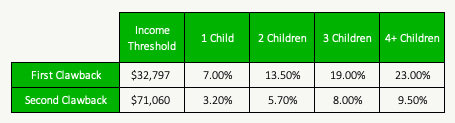

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Child Tax Credit Payments Started Hitting Bank Accounts Today Here S What You Need To Know

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Measuring What Matters Toward A Quality Of Life Strategy For Canada Canada Ca

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

An Update To The Budget Outlook 2020 To 2030 Congressional Budget Office

Child Tax Credit Payments Started Hitting Bank Accounts Today Here S What You Need To Know

An Update To The Budget Outlook 2020 To 2030 Congressional Budget Office

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)